This summer’s markets were initially driven primarily by concern regarding the potential impact of the Covid Delta variant worldwide. As summer turned to fall the Delta variant’s fade gradually became clear and the dominant factor shifted to supply chain bottlenecks around the world and whether current high inflation was transitory or long-lasting. Part and parcel of that is the level of US government spending. The Whitehouse had proposed a one-trillion dollar first spending authorization followed by a further 3.5 trillion dollar spending authorization. That would be a lot of money dumped into the economy!

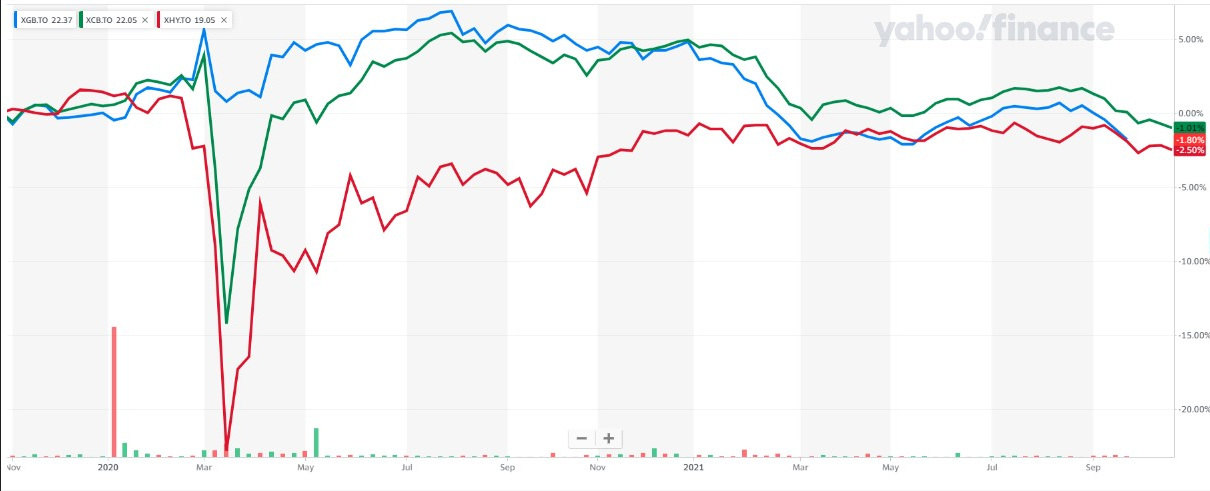

Bonds and Interest Rates

As I mentioned in early July the bond markets this summer continued working hard to parse out the details of inflation, the recovering economy, and the likely government response (i.e. the potential for rising interest rates). Although employment is improving, there is still a possibility for stagflation where inflation is running high but the economy is wallowing and the government can’t raise rates without killing the main-street economy. I do believe that is the reality we face, to a certain extent. We will see the Federal Reserve try to ease off with their bond buying, which has depressed interest rates for a while, but the Fed won’t go as far as some pundits think, for fear of quashing the economy. As a result, they will not be able to fully address the inflation and it will continue at rates above the 2% target for at least the year to come.

Fig. 1: Bond ETFs: Gov’t (XGB), Corp (XCB), High Yield (XHY) – 2 years – Yahoo Finance

As a side note, when completing my MBA over 20 years ago we had a supply chain simulation where we looked at disruptions to the chain and how many purchasing cycles it took for the chain to restabilize. It took a long time! Now, to me it is shocking to see how shocked experts are on the length of time to restabilize supply chains. This was a basic lesson two decades ago! It will take time and meanwhile the prices of various items that are in short supply will lean higher.

This summer the Fed became more hawkish (leaning toward raising interest rates) and so bonds fell slightly but in my mind they can’t go far. There is now so much debt across government, the housing sector, and other industries that the economy simply can’t tolerate much higher rates. That is why I believe the Fed (and to some degree central bankers here in Canada too) is painted into a corner – they can’t raise rates much. With that in mind, we remain comfortable holding some bonds as a diversifier for when the stock market takes a deep breath.

By the quarter’s end there were concerns that the government spending would exacerbate inflation and force rates higher (and stock markets lower). After the quarter-end it has become evident that 1) the US government needs to pare back the $3.5 trillion spend to get it through Congress and 2) the US labour market is getting on board with the recovery. As such, the market expects inflationary pressures and stagflation risk (stagnant economy alongside high inflation) to be less extreme than the scenario envisioned 4 months ago.

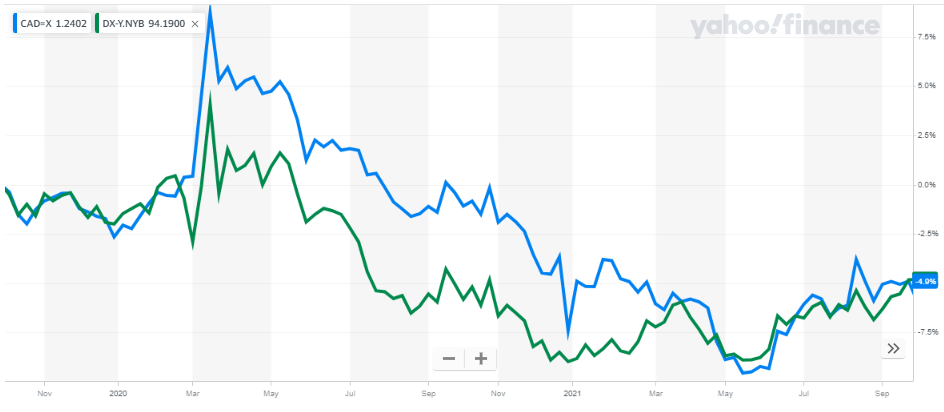

Currencies

Economies around the world are healing from the pandemic at different rates. As a result central banks around the world are able to raise interest rates at different paces and therefore their currencies don’t all strengthen equally. Canada has recently been one of the strongest recovering economies. If you add to that the fact that our top export (crude oil) has experienced a dramatic price escalation, you can understand why the CAD is strengthening in USD terms and indeed against currencies around the world. Even though the USD has done well versus major global currencies (green line in Figure 2 has been rising since May) the CAD has been doing even better, with the USD weakening against the CAD since its peak in August. Just in time for the border reopening and the snowbirds heading south!

Fig. 2: US Dollar Index and Cdn Dollar vs USD – 2 years – Yahoo Finance

Looking ahead we can expect the CAD to remain strong until a stock market panic occurs. These panics (stock market pullbacks) are an inevitable part of equity investing and although we cannot predict the timing of shifting emotions, we need to recognize that reality. Recently in our fixed income allocations many accounts have added a US bond pool to their holdings. This implicitly increases the US currency exposure versus holding Canadian bonds. This is an intentional move to provide more stability when stock markets pull back and safe-haven currencies (US Dollar, Japanese Yen, Swiss Franc) typically rise versus other currencies.

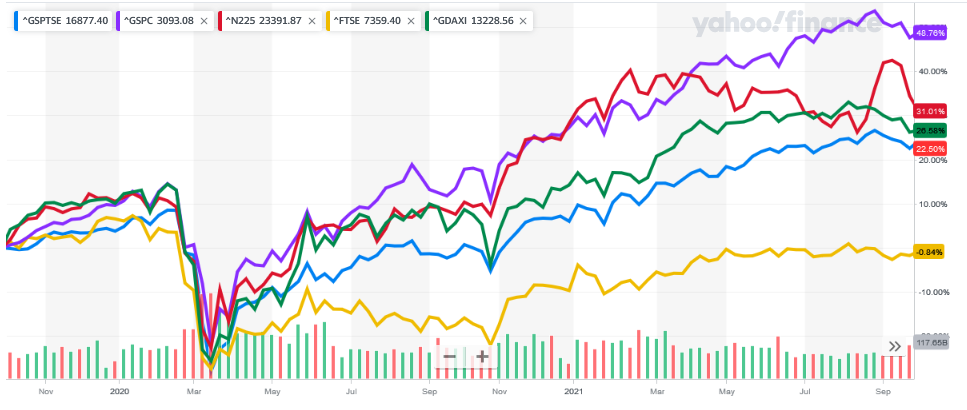

Stock Markets

This summer equity markets continued to rise but by the beginning of September the bloom was off the rose (actually Japan has been fading since February.) Various equity market fell through September to hit a short term low (which we can only know with the benefit of hindsight) at the end of September/beginning of October. As such we did some trading just after the end of September in response to this opportunity created.

While it is easy to find a chart of the overall equity market behaviour, that does not convey the trends happening “under the covers.” The major trend is driven by how equity markets are interpreting the broad economic situation and the bond market response. Think of that as (at least) three blocks:

1) most high-growth tech stocks won’t generate meaningful profits until many years into the future. Therefore, they like a low discount rate (low bond yields) so that those future profits are just slightly discounted to the present and are still big numbers in the end. When bond rates are looking to rise, tech stocks tend to be falling and vice versa.

2) consumer packaged goods are feeling the brunt of cost inflation. As their raw material input costs rise they can only maintain their margins if they can pass on cost increases through higher prices to consumers. This is not easy. Too much price escalation and consumers reduce their purchases. Hence consumer packaged goods companies (like our Unilever holding) are facing stock price pressures because they are facing challenges passing their cost increases along to consumers. They can only raise consumer prices so much. That said, once they have successfully navigated this tough profit-squeeze phase and cost inflation abates they should look great in the long run.

3) the natural resource companies and various others (e.g. container shippers) are the bottleneck in the whole supply chain situation. Therefore, we are seeing price escalations for oil, coal, many metals, crops, and other commodity areas. To some extent these stocks have the wind to their back right now but we need to be cautious – these businesses are highly cyclical.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

We are looking for opportunities to take advantage of these trends but we do not want to be dragged into the hot-trader mindset. We are looking at what is panning out through the eyes of a long-term investor.

You will recall that in the springtime we sold the position many accounts held in Shaw Communications following Rogers’ takeover bid for Shaw, which made the stock price leap higher. Following that sale we were looking for an opportunity to increase exposure to the telecoms space and specifically looking at Rogers Communications. Awaiting a better entry price for Rogers we have not yet purchased any shares and thankfully so – current boardroom drama at Rogers has pushed the stock price meaningfully lower, from above $67 in July to a recent low just above $56.

Respectfully submitted,

Paul Fettes, CFA, CFP

Chief Executive Officer,

Brintab Corp.

Leave a Reply