Commentary January 2022 – Digesting Omicron and Persistent Inflation Impact

There were many winds washing through the markets in the months leading up to the New Year. Hence it was a tumultuous time. To name a few:

- The Delta variant succumbed to the milder yet faster-spreading Omicron

- US hostilities continued with respect to China, Russia, and Iran

- Covid fatigue and resistance to lockdowns led many people in various developed countries to either stage protests or simply ignore Covid and go about their business

- Omicron spread like a prairie grass fire and the widespread sicknesses and self isolations led to staffing shortages that crimped many businesses – notably airlines had to reduce operations to cope, although planes were reportedly half empty anyway.

- Kazakhstan faced widespread revolt against fuel price increases – oil and uranium prices rise and Russia landed troops into Kazakhstan to support the government and put down the protest.

- Various economists (most notably at the US Federal Reserve) who had been declaring inflation to be temporary acknowledged that either it was not as temporary as they thought or that “temporary” meant more than just a few months.

- West Virginian Senator Joe Manchin singlehandedly killed the Biden’s government’s hope to roll out a $3 trillion stimulus package (that had already been dialed back to $1.75 trillion through compromise). This would have been on top of the $1.5 trillion infrastructure bill already passed.

- Europe declared natural gas to be “green energy” (happened just into the new year).

Wow. That’s a lot to digest!

Bonds and Interest Rates

Roughly speaking, bond returns move inversely with the likelihood of central bankers raising interest rates, which markets anticipate as economic fear factors dissipate (or rise) and a recovering/inflationary economy increases chances of central bank rate increases.

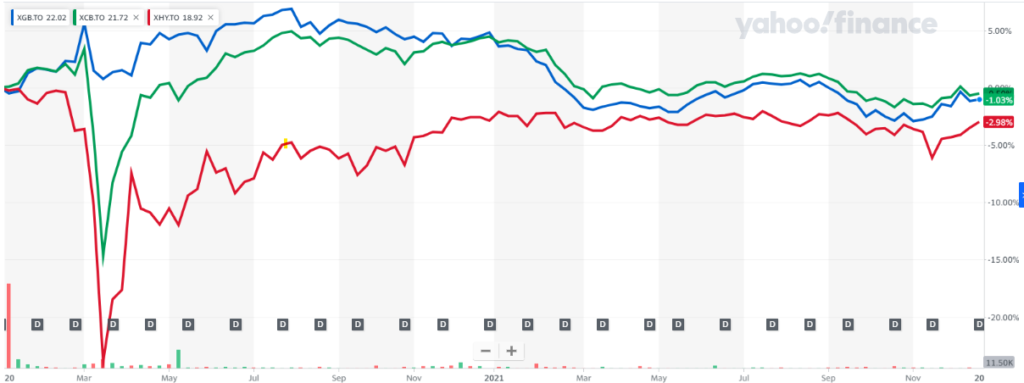

Fig. 1: Bond ETFs: Gov’t (XGB), Corp (XCB), High Yield (XHY) – 2 years – Yahoo Finance

We can see from the bond chart above that safe haven government and high-grade corporate bonds (green and blue lines) rose in the summer as the Delta variant dominated, fell in the early fall as the spread of Delta slowed (and economic recovery was anticipated) and then rose again into November as the Omicron variant surged around the world. Now in the New Year (not shown on the graph) we are seeing bonds fade again as Omicron gets under control, inflation is proving to be more persistent than central bankers had expected, and there is increasing commitment among central bankers to raise interest rates to keep inflation in check.

Looking ahead, fixed income investing is likely to be challenging. On the one hand an increasing interest rate regime is bad for bond holders and on the other hand holding bonds is a very important way to protect against a geopolitical or economic shock. Our job will be to mitigate these two opposing factors.

Currencies

Since roughly May 2021 the US Dollar has been strengthening against the Canadian Dollar and against a basket of world currencies. This is essentially because the US economy is recovering faster than other economies and US interest rates are likely to rise faster than in other countries. Such is the case somewhat because the US population was more insistent than other countries on reopening the economy despite collateral damage in terms of Covid sicknesses/deaths. Although this cycle’s explanation relates to post-Covid reopening, the truth is that in most cycles the US economy and markets recover faster than elsewhere. This is largely driven by the US preference to have a more “laissez-faire” market stance that results in more aggressive restructurings, layoffs, etc. in downturns but positions the economy with a faster, stronger rebound when things recover. This is typical in most cycles even when Covid is not a factor.

Fig. 2: US Dollar Index and Cdn Dollar vs USD – 2 years – Yahoo Finance

That said, we often see that later in a recovery the US Dollar’s strength subsides as economic recovery spreads to other countries. Of particular interest north of the 49th, the Canadian Dollar often recovers strength when the oil industry recovers, which is typically part of a global rebound after the US economy has led the way.

Stock Markets

Although stock markets experienced some October recovery from their Delta variant-induced September pullback, we now see that from the beginning of November they finished out the year either flat (US and UK) or down from October (Canada, Japan, Germany) as the Omicron variant and other global concerns I mentioned at the outset took a toll. Importantly, central bankers (especially US Federal Reserve Chairman Jerome Powell) telegraphed intentions to take inflation more seriously and raise interest rates several times during 2022. This threw cold water on equity markets and especially tech stocks. It drove the beginning of a sectoral rotation out of tech stocks and into more conservative stocks as investors sought safety.

I would note that through 2021, although we had not completely written off strong technology businesses, we were leaning towards and net acquirers of conservative investment alternatives so this market shift played somewhat to our strengths.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

Looking ahead, while we continue to scour for good individual businesses, I expect our view will be influenced by 1) how completely the stock markets absorb the interest rate increase news/expectations, and 2) the degree to which inflation fades or remains strong. One of the biggest sectors where rising interest rates have the potential to cool things off is the housing sector. That is one place to look for telltale signs that inflation-driving demand is easing as interest rates rise.

Respectfully submitted, Paul Fettes, CFA, CFP Chief Executive Officer, Brintab Corp.

Leave a Reply