With the gradual reopening of businesses post-Covid, we are seeing glimmers of hope regarding the economic recovery. Still, the pandemic created chaos that continues to settle out bit by bit. There were changed buying habits, pent up demand, supply chain chaos, bankrupt businesses and unemployed workers that, beyond the first level of the recovery, where the rising tide floated all boats, has now left us having to get a refined assessment of what is back to “normal” and what parts still have a long way to go.

Bonds and Interest Rates

There has been so much stimulus by central banks and so much central bank support for governments (especially the US) spending and going deeper into debt that stock and bond market participants have been walking on eggshells wondering when and how intensely central bankers will start to jack up rates as the economy recovers. In terms of cooling off overheated markets will it just be a cool mist or an ice bath?

There was not much deviation by central bankers from prior guidance until mid-June. Investors were becoming increasingly concerned that the US Federal Reserve was going to let inflation get too wildly out of control without reining it in by boosting rates. Then in June Fed Chairman Jerome Powell, followed by others, made comments about recognizing that inflation had grown more than expected, that some of it was not transient, and that interest rates may increase sooner than previously thought.

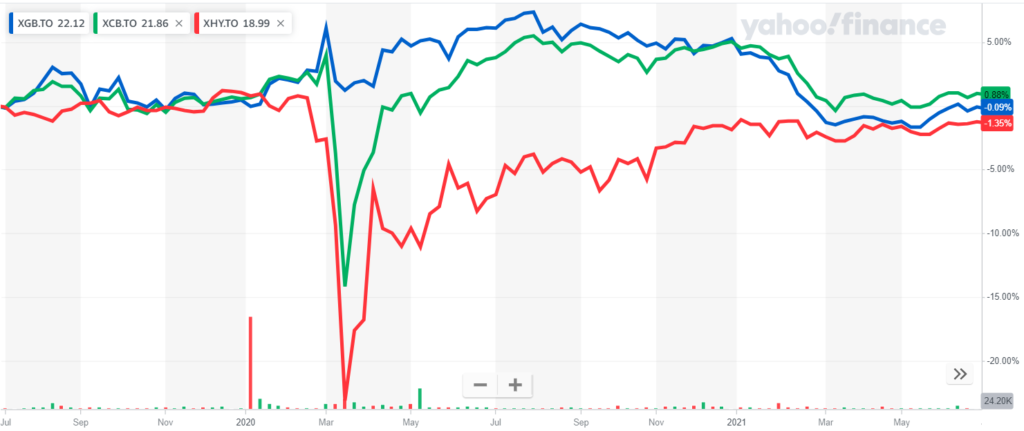

Fig. 1: Bond ETFs: Gov’t (XGB), Corp (XCB), High Yield (XHY) – 2 years – Yahoo Finance

This triggered a mid-June market pullback as can be seen in the response of the bond market, the US currency, and the stock market. Even though this interest rate rally grabbed a lot of headlines in June’s financial papers, you can see from the tiny dip in government and corporate bond ETFs in June that it was trivial compared to the ups and downs we have seen in bonds over the past two years. Now we do expect that bond yields will face some upward pressure on the horizon but the reality is that there are certain areas of the debt markets (mortgages, corporate debts) that would feel major strain from even the slightest rate increase and so the Fed (and other central bankers in many countries) likely has its hands tied – it can’t let rates rise much.

That implies the central banks may have little choice but to keep rate increases modest even though some segments of the economy are experiencing ongoing inflation. This results in a difficult scenario for bonds. To be precise, corporate bond yields may barely keep ahead of inflation. With stock markets somewhat bubblish, it will pay to have some money in bonds when the stock market pulls back but upon witnessing a regular business cycle pullback, it will likely be high time to keep government bond exposure low.

Currencies

To a certain extent, you can consider interest rates and currency exchange rates as joined at the hip. They are strongly linked to how one country economy is doing relative to another. For example, if the US economy is floundering (forcing the US fed to keep interest rates low) while the Chinese economy is recovering strongly (causing Chinese central bankers to raise interest rates) then all things being equal we would expect the US Dollar to weaken while the Chinese Yuan strengthens. A huge flow of bond investors would be converting their cash from USD to Yuan to buy higher yielding Chinese bonds, putting downward pressure on the USD and upward pressure on the Yuan. This happens with currencies around the world as they jostle to establish exchange rates reflective of each economy’s strength relative to each other[1].

Fig. 2: US Dollar Index and Cdn Dollar vs USD – 2 years – Yahoo Finance

With that in mind we can see (Figure 2) that since the Covid-induced US Dollar spike in Mar 2020 the US Dollar has faded not only against the CAD (blue line) but also against a basket of currencies (green line). It is clear that the US government is going to need to spend extensively (and the central bank to keep rates low) for a significant period of time while other economies (especially global economy number 2: China) are poised to recover much better.

In June 2021 we can see that the USD recovered somewhat against the CAD and also against a basket of currencies but this June bounce still leaves the USD meaningfully down since its pre-Covid levels of 2019. The new range is likely where the USD will settle out for a while until we eventually see more clarity on how different economies are recovering from the Covid-induced economic shock and also how various geopolitical tensions play out under the Biden regime, especially with respect to US-China relations. As such, the relative economic strength may be fading in importance and the safe haven effect may be rising in importance as it relates to the USD exposure decision. That spells a continued role for US stocks (as opposed to Canadian stocks) in portfolios, since it has been some time since we have experienced any geopolitical shock.

Stock Markets

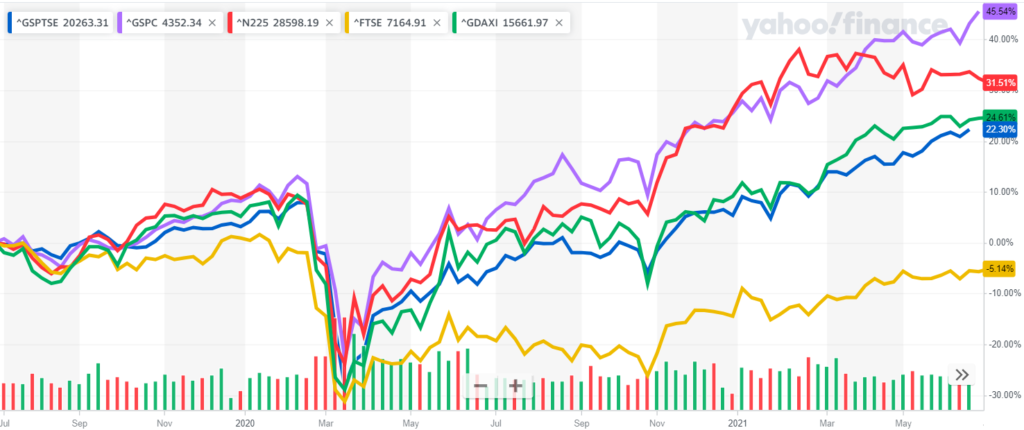

Through the late spring we saw Canada continue to gradually build strength while we saw a continued decline in Japan and roughly flat-lining in the UK, Germany and the US (until the US market once again bounced higher in June). The continued Canadian strength spanned various industries but of particular note (because the industries are so big) are banking and oil.

The banking sector is being driven by modest non-performing loans, strong loan growth and rising net interest margin. People are getting back to work and mortgage delinquencies are less than feared. As housing prices skyrocket, so does mortgage loan growth. Furthermore, if you consider that banks borrow short term (daily chequing accounts etc.) and lend longer term (e.g. 5 year mortgages) then they will do well when 5-year rates rise up while short term rates stay pinned low. That is exactly what we are seeing now.

In the oil sector, despite long term pressures to move away from fossil fuels, the industry is still driven primarily by the near-term price of oil. That has been on the rise and has helped the oil industry. There are constant debates about when Iranian oil will return to the market in volume, and about the pace of demand recovery around the world (i.e. people driving once again in a post-pandemic environment.) The balance of oil supply and demand is something hard for OPEC to finesse and equally hard for investors to predict. Nonetheless oil has been on the rise, taking Canadian energy stocks with it.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

With all this froth in equity markets, one might wonder where we go from here. It is worth remembering that timing market tops (and bottoms too) is supremely tricky business. That said, our current efforts to put money to work is focusing primarily on low volatility investments. For example, just at the close of the quarter we made a purchase in numerous client accounts of some preferred shares of Enbridge. Without getting into the details of the security, you could generally consider that preferred shares are lower volatility than common shares and are usually bought primarily for their dividend yield, which for the Enbridge pref was high single digits. Furthermore, for any taxable accounts they are taxed more gently than bond interest. We continue to look for opportunities to put money to work earning returns that are more reliable and expect to find some over the summer. Stay tuned. In today’s market it is not likely the time to layer on a lot of additional risk.

In the April letter I wrote “In the time since the 2008 financial meltdown just over a decade ago, we saw many corporations use the presence of low interest rates to load up on debt and pay out profits to shareholders. They mostly did this by buying back shares in the open market and cancelling them. If the same company has fewer shares outstanding, then implicitly the value per share rises.”

The caveat to this is that the company should be paying to retrieve the shares from the market a price that is less than the company’s value per share. Some companies carry out buybacks willy-nilly regardless of whether their own shares are undervalued or overvalued. Other companies like Berkshire Hathaway and Fairfax Financial take a much more calculating approach to this. They buy back specifically when they think their own shares are undervalued. When management that we believe in buys back shares, we see it as a strong vote of confidence for the business. This spring Fairfax India (run by the Prem Watsa team at Fairfax Financial) undertook a buyback. Normally a company would buy back shares in the open market and you would not directly hear about it but Fairfax India did it by way of a Dutch Auction. You may have received materials in the mail giving you the opportunity to tender your shares to the buyback. The company is run by someone often called the Warren Buffett of Canada. Prem Watsa’s leadership is one of the reasons for the Fairfax India investment in the first place. Furthermore, once the toll of Covid has abated in India, the country has strong long run growth prospects. As such I have not tendered any shares to the offer. I think it’s better to stick with this management team for the long term and I certainly appreciate seeing their strong vote of confidence in their own long-term prospects.

Respectfully submitted,

Paul Fettes, CFA, CFP

Chief Executive Officer,

Brintab Corp.

[1] To be precise inflation should also be considered. Furthermore other effects also play a role such as the safe haven effect that historically favours the US Dollar, Japanese Yen and Swiss Franc.

Leave a Reply