This summer into fall, markets have been fixated on the economic “soft landing” narrative and the notion of rates being higher for longer. It is true that circumstances have made it tougher than in past cycles to slow down the economic freight train, but that likely just means harsher interest rate increases, and more likelihood of something breaking along the way. Fortunately, we feel comfortable with our preparedness for that, while we feel some investors are really throwing caution to the wind.

Bonds and Interest Rates

In the bond market we can see the impact of the economy needing stronger medicine to bring down inflation. As central bankers in Canada and the USA continue to monitor the economy (especially the inflation it is experiencing), they see that “goods inflation” has largely come under control but “services inflation” is still high and the labour market is still very tight (pushing wage inflation). This after a record increase of short-term interest rates (with long term rates gradually following them up, too). Longer-dated bond prices are much more sensitive to a particular change in interest rates than short term bonds experiencing the same interest rate change. That is why we can see that longer dated bonds (purple line in Figure 1 below) have declined more than shorter term bonds. We generally have some mix of shorter and longer dated bonds in portfolios. In the past year we have been shifting our holdings more towards the longer-term bonds. After the long-term bonds bottomed in October 2022, they rose into the end of the year before declining once again in the summer of 2023, even though a recession had not yet happened. We expect these long-term bonds to find a floor and then rise again as stock markets decline and investors seek out safer investments. It looks like what we thought would be a 2023 phenomenon will more likely be witnessed in 2024. In any case we feel ready. We expect to be buying more long-term bonds at current low prices.

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

In looking for signs of impact from the interest rate increase, the primary result worth noting is that particularly in the US, where homeowners can lock in 25-30 year mortgage rates, the number of home sales transactions has declined dramatically to an annualized rate of just over 4 million units (see Figure 2, below). First of all, owners with a mortgage are not eager to move and trigger a refinancing at the new, higher rates. Secondly, would-be home buyers who are not yet in the market are being squeezed out by the higher required mortgage payments.

Fig. 2: Annualized number of existing home sales transactions, by month – from NAR

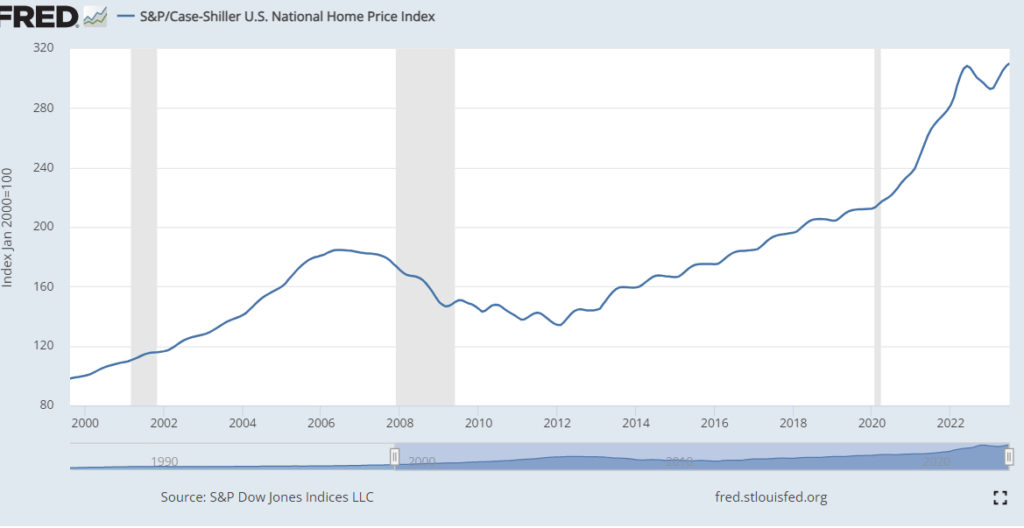

In the housing market price declines are usually preceded by sales volume declines so it wouldn’t be surprising to see prices drop around the corner. In 2023 prices teetered (Figure 3 below), but haven’t yet shown the impact. When home prices fall, some people feel their wealth is in jeopardy so leisure spending falls too.

Fig. 3: US existing home sales price index, from St. Louis Fed.

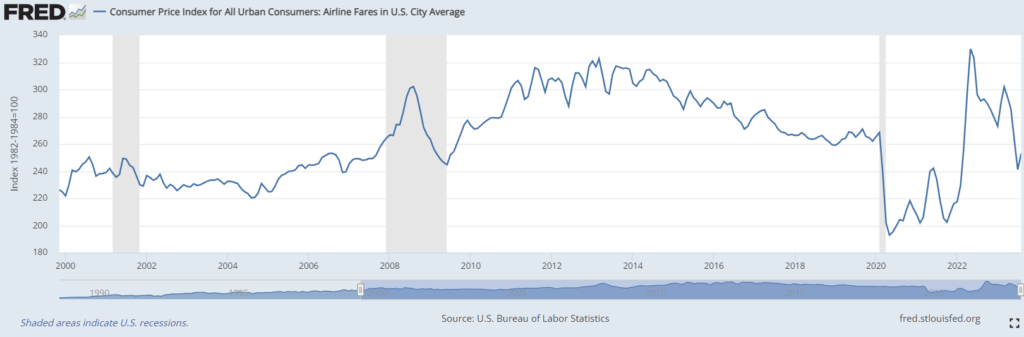

As an illustration of the leisure space starting to cool off, we are starting to see telltale signs of slowdown, such as in airline ticket prices. After Covid, when airlines struggled to manage the travel demand, prices skyrocketed (Figure 4, below). Now, not so much. This is just an example for illustration; we can see similar signs of cooling off in various parts of the service economy.

Fig. 4: airfare pricing trends, St. Louis Fed.

When markets freeze up (fewer transactions happening) they don’t work as smoothly. That means there is more chance that the transition to recession will be a bumpy ride. While that outcome is not guaranteed, it is an increasing probability. Holding long maturity US bonds is a typical safe-haven strategy when other things struggle.

Currencies

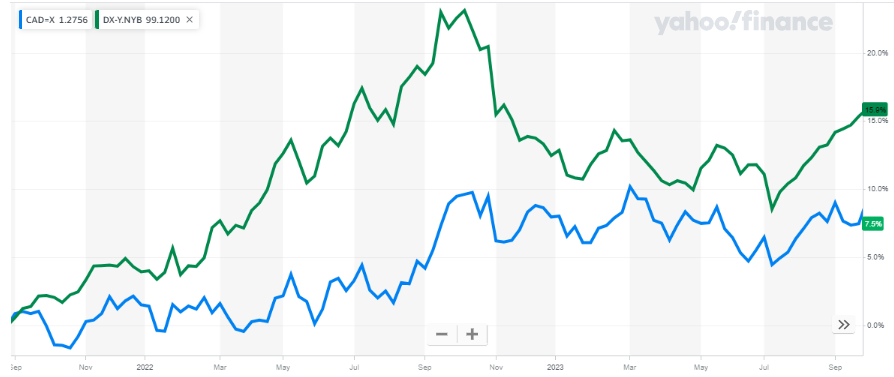

As US interest rates have risen, that has made US Dollar-denominated bonds more appealing so, as we would expect, the US Dollar has strengthened with it (Figure 5, below). Before summer there was widespread belief that interest rate increases were done. Then this summer the US economy continued to show resilience so there is a growing belief in the market that the US Federal Reserve will need to raise US interest rates even further to cool down the economy. Now the Canadian Dollar is trading at about 1.36 CAD per USD or on the reciprocal 0.735 USD per CAD.

Fig. 5: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

As discussed in the past, it is not only rising US interest rates that strengthen the US Dollar but also geopolitical fear/panic. At the moment, I believe the US Dollar is near its top as far as the interest rate impact is concerned, however the US Dollar could still bounce stronger if an extreme event happens. Notably, at the time of writing the Hamas attack on Israel just happened and the US Dollar did not strengthen in response. This conveys that the market expects the fallout of the Hamas attack will be contained.

Stock Markets

As illustrated in Figure 6 below, there was not a uniform global stock market trend this summer. The markets in the US and German clearly declined through the summer, while those in Canada and Japan were roughly flat and the UK market rose. This contrasts with October 2022, when we saw most major worldwide markets dip in unison.

Fig. 6: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

The fact that stocks and bonds have both been soft together has made this summer a challenging investment market in the short term. However, as we progress towards a cooling economy there should be less of a tendency of stocks and bonds to move together, thus improving our diversification. With respect to different types of stocks, gradually we are approaching a time when utilities and similarly steady businesses tend to outperform the market, which is the basis of our forward-looking asset rebalancing bias within the stock category right now.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply