The Autumn season in the markets was punctuated by concerns over the Israeli-Hamas fighting and its geopolitical impacts, watching with bated breath about how consumers would digest the insidious impact of interest rates, and in China a property market decline that was spilling into the broader economy.

Bonds and Interest Rates

Over the course of the fall months, the Bank of Canada and US Federal Reserve leaders repeatedly expressed that interest rates would remain higher for longer, as they watched and waited for broad inflation statistics to gradually decline below their 2% target. Meanwhile, those bond investors who are macroeconomic-focused were digging into the statistical details and noting that various signals showed cooling was well underway, even if it hadn’t hit the main inflation numbers yet. They were looking at things like the number of people with second jobs, delinquencies on car loans, how many of the newly created jobs were part time versus full time, and more. Early in the quarter the central bank chorus on the interest rate outlook of “higher for longer” prevailed and rates rose into October (which is why bond prices fell in Chart 1 below) but later in the quarter the voices of market analysts won out and the Federal Reserve softened its stance, implying there might be space for short term interest rate cuts later this year (2024). As a result, bond interest rates fell (slightly) and bond prices rose from mid-October toward the end of the year. In fact, bond prices rose so fast that at the New Year many market technicians felt there was too much euphoria, and bond prices would have to pull back a bit in early 2024, which did happen.

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

The economic slowdown is continuing and I do think, especially since the slight long bond rate rise in January 2024 that interest rates have more to fall (and bond prices more to rise) in the year ahead but the moves will be more gradual than the bond price bounce we saw in November-December.

Currencies

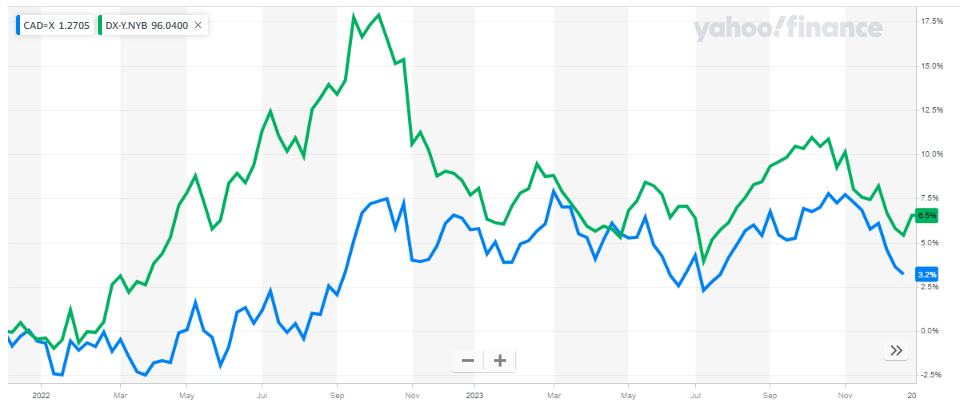

As is typical, when US interest rates rise like they did through September, the appeal of (and price of) the US Dollar rises. Then when US interest rates fall (like the November-December behaviour) the US Dollar weakens. Figure 2 shows this clearly.

I have mentioned before that the biggest violator to that generalization is that if there is a major geopolitical scare, there is a rush into “safe haven currencies” which usually pushes up the value of the US Dollar, Swiss Franc, and Japanese Yen regardless of interest rates. Interestingly, we can see below that the October 7 attack by Hamas on Israel and the ensuing hostilities there and that spread to various countries on the Middle East did not lead to any major move in safe haven currencies, signalling that global investors see it as a temporary localized issue.

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

When we consider buying long-term Canadian and US bonds, with the exception of the “fear trade” currency impact (which would favour the US), there will come a point (exchange rate) where we would consider diversifying our US long bonds with some Canadian long bonds. We haven’t reached that yet but we are aware of it. To be clear, we are not talking about a precise exchange rate; we are talking more about what investor sentiment we consider embedded in the exchange rate. We watch, for example, whether bonds are moving with or against the stock market. We watch if the best parts of the stock market are non-cyclical businesses or speculative ones, we watch how much fear-mongering we see in investment news media.

Stock Markets

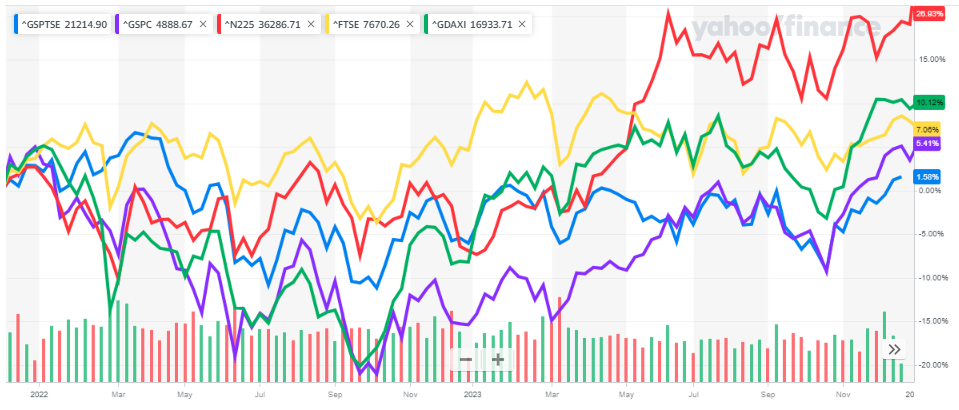

Although the Canadian stock market bounced around for the first part of the year without much trend, in September and early October it pulled back along with most major global markets, before staging a rally in the back half of the quarter (and into early 2024, too).

By the end of the year, after the October trough most global markets recovered to have slight moves (slightly higher or lower) from their mid-summer peaks but the US stock market was the exception. It moved meaningfully higher, largely on the backs of the “Magnificent Seven” tech businesses (Facebook, Tesla, Microsoft, Google, Apple, Amazon, Nvidia). I have talked in the past about how unhealthy it is for the S&P500 stock average to be driven higher by just a small cluster of (in this case of 7) stocks while the rest of the companies muddle along to varying degrees. The speculative fervor creates the risk of a Nortel-style crash of those stocks that brings down the average. Of course, there is no doubting that they are good businesses but gambling on high-flyers is not typically our style and right now we are trying to insulate our investors from the change in focus of fad investing.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

During the quarter we sold Suncor. While we do think the soon-to-be inaugurated Transmountain Pipeline should improve Albertan oil prices and if Albertan nuclear power talk leads to anything it eventually could make Suncor one of the lowest carbon sources of oil in the world, in the meantime there is risk of a recession which typically leads to a decline in oil stocks. This is part of our efforts to gradually reduce exposure to equities overall and at the end of the quarter equity exposures were in most cases down to about 50% of portfolios overall.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply