The first quarter of 2023 had markets driven most dramatically by the US interest rates, their repercussions, and whether the US Federal Reserve would pivot from an interest rate increasing phase to an interest rate decreasing phase.

Bonds and Interest Rates

We can see that last year until about October bonds declined as the US Federal Reserve (and the Bank of Canada, too) engaged in the steepest interest rate increase in history. Once that steep increase was plateauing, bonds found their footing and basically since the start of 2023 have been roughly flat while bouncing up and down in a more typical range.

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

Central bankers (and market participants too) are now attempting to judge whether the interest rate increases to-date are enough to cool off inflation or not. Inflation is certainly easing from the high single digits we witnessed a year ago, however are the increased interest rates the cause of this inflation slowing down? Maybe not. The reality is that last year the craving for post-Covid spending was still rampant and the supply chain issues had not yet been fully resolved. High demand with constrained supply mean prices escalate. While I think interest rate increases have played some role in cooling off inflation, in truth I believe the heavy lifting came from getting the core economy back to normal operations (supply stabilizing and feverish demand easing off).

Traditionally it takes many months for higher interest rates to trickle through to fully impact the economy. As borrowers renew their mortgages, take out new car loans, and refinance corporate debt, the higher interest rates are gradually going to squeeze more and more people. The full impact of interest rate increases is still coming down the pipe. Recently central bankers are talking about pausing the interest rate hikes to see how much impact the increases carried out so far will have on inflation before hiking further. I believe we may see an additional 0.25% increase but not much more. As we wait and watch the impact of these interest rate increase, inflation and the economy will cool more and more.

One complicating factor is that in China, where there was a very heavy Covid-induced lockdown, there has just been a reopening starting in December 2022. I do not believe it will outweigh the impact of interest rate increases in other countries. The two dominant parts of the Chinese economy have been manufacturing for export and construction. With respect to the construction, there is an astounding inventory of empty condos in Chinese cities now, with builders building and speculators buying purely on the basis that prices kept going higher. Now that prices have stabilized and/or declined in various areas, it feels like the feverish level of Chinese construction has eased. Meanwhile, looking at export-driven production in China, that basically hinges on developed world consumer demand. Now we see major corporations in the US taking preventive steps to anticipate a recession with moves like hesitation on supplier orders and either laying off employees or at least instituting hiring freezes. Hence, consumer demand in the USA and Europe, which drives the Chinese economy, is likely weakening. In conclusion, I do not believe the impact of Chinese reopening will significantly counter the cooling developed world economies.

I would be remiss if I didn’t mention the fall of a relatively significant US regional bank this winter. Silicon Valley Bank failed last month and various other regional banks were known to be in a very tight financial situation. This is illustrative of how the central bank interest rate hikes are starting cause pain in various parts of the economy. The impact here is twofold. Firstly, banks are tightening their willingness to lend as a precaution and secondly, bank stocks have declined as investors themselves exercise caution. Issues like this are to be expected as the economy progresses toward what I consider an inevitable recession.

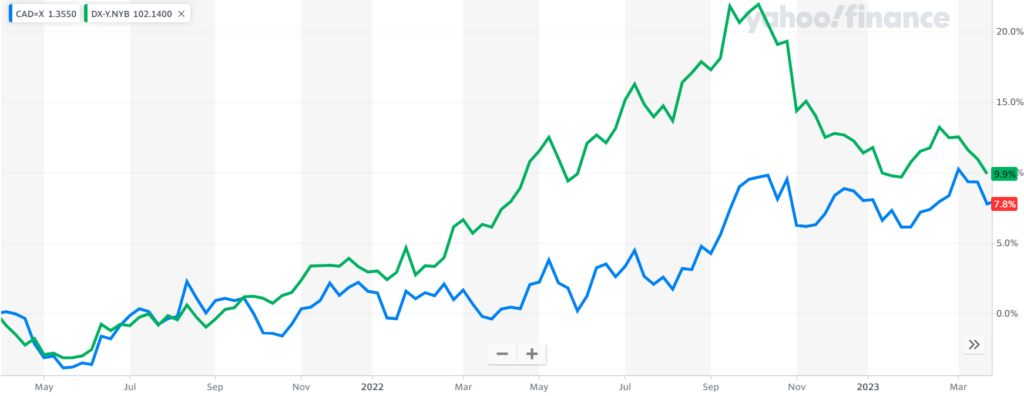

Currencies

Although the US Dollar strengthened until October 2022 against both the Canadian Dollar (blue line in the chart below) and against a basket of major currencies (green line), we can see that since October the USD/CAD exchange rate has roughly stabilized and in late last year the USD actually declined against the currency basket. In Europe there was a feeling that the worst of the war-driven impacts have been absorbed and in Japan there has been for the first time in years, discussion of raising interest rates.

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

Once it is clear that the Federal Reserve has raised interest rates enough, a recession is unfolding, and interest rates should decline, then the US Dollar will decline too (likely in 2024). However, in the meantime, if the tightening of interest rates causes a major market breakage anywhere in worldwide capital markets, the US Dollar typically rises as a “safe haven” play. I do expect breakage somewhere and so I do expect the US Dollar safe haven role to unfold, before once again the fear subsides and it is time for other currencies like Canada’s to have their day in the sun.

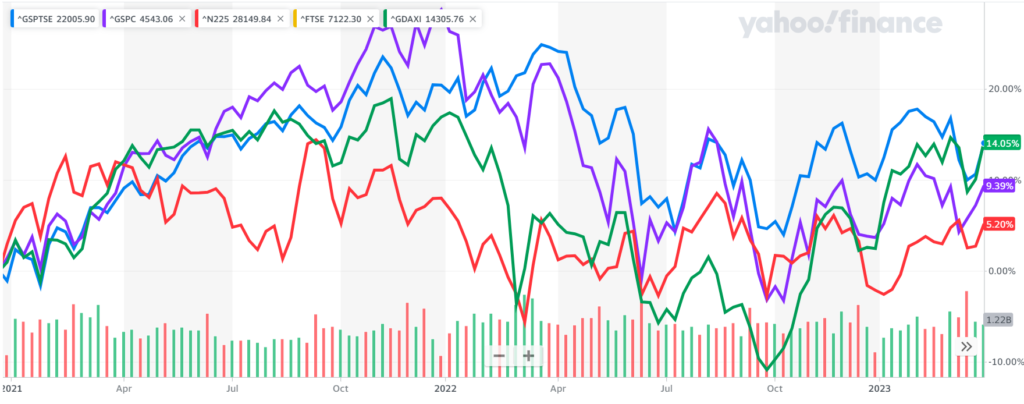

Stock Markets

After a difficult 2022, in the first quarter of 2023 stock markets around the world rose up in January and February before retrenching in March. Since then, they have started inching higher again but we are not out of the woods yet!

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

I believe market participants are hoping that the interest rate increases are done and their impact on the economy is done so they believe the 2022 pullback the stock market experienced was the purge that was needed to let off steam. That is likely wrong. Generally speaking, it is not possible to get inflation under control without some increase in the unemployment rate and that has not happened yet. To the extent that central bankers stick to their inflation reduction goals (i.e. they don’t cave in to political pressure) then unemployment will come.

We have seen some “rotation” in the stock market where less cyclical sectors like healthcare, consumer staples (groceries, etc.) and utilities have done well while more cyclical sectors have struggled. This has somewhat played to our strength as we have had a strong weighting in those sectors that are more in favour.

Given where we are in the economic cycle, this winter we have been gradually trimming exposure to various equities and increasing exposure to long-duration bonds, primarily through purchases of EDV. We have continued this general trend after the end of the quarter too, and expect further opportunistic trimming and rebalancing as the situations present through the spring and summer.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply