This quarter, as inflation continued to thrust forward, the US Federal Reserve aggressively raised interest rates to try to get their inflation-busting measures back on track after being caught off-guard earlier in the year. The only major sign of relief in “goods” inflation is coming from the fact that economic reopening has allowed US consumers to redirect some of their spending on leisure (travelling, dining out, etc.) rather than solely on goods purchases (new furniture, backyard renovations, etc.) The Russian invasion of Ukraine has not only impacted commodity prices (near term effect) but also triggered a reassessment of military spending by NATO countries. This second factor is milder to be sure, but could be a slight inflationary spending factor with a very enduring effect if it lasts a decade or more. Similarly, it seems globalization is now firmly in reverse.

Bonds and Interest Rates

As consumer spending shifts from goods to services we are witnessing inflation shifting to that sector too. The inability to properly staff airline operations has led airlines north and south of the border to reduce their flight schedule, particularly near the end of the quarter. For sure this leaves consumers scrambling for the fewer available seats, no doubt at top fare prices.

In response to the persistent high inflation the US Federal Reserve recently raised interest rates by the once inconceivable 0.75% and announced the likelihood they will do it again this summer. A combined 1.5% interest rate impact in such short order would amount to the steepest increases in over 40 years. We are already starting to see signs of impact in dwindling US mortgage refinancing and a slight cooling of the US housing market overall. Upping the ante, the Bank of Canada just raised rates after the quarter’s end by 1%. Wow!

Historically bonds have over the long term moved somewhat opposite the stock market. When stocks went up bonds often went down and vice versa. As I telegraphed over the past couple commentaries, the bond market has been challenged to fulfill that counterbalancing role, instead moving alongside the stock market. During this quarter we have seen some signs of that abating, with bonds occasionally moving opposite to stocks (hurray) and thus starting to show signs of reverting to their traditional offsetting role. I expect to see more of that ahead.

Often the long bond market moves in anticipation of where the central banks are going with benchmark interest rates. The market predicts inflation and adapts before the Federal Reserve has a chance to make any formal announcements. Now it appears that long maturity bonds have already priced-in rate increases that are expected in the Federal Reserve short term rates and so it appears the tough time for long term bonds is coming closer to an end.

In addition to the customary depiction of medium-term government bonds, investment grade corporate bonds, and high yield bonds, I have included in the chart below the movement of long-term government bonds. TLT is a pool of roughly 20-year US government bonds. We can see that these long bonds have had the toughest time but once interest rate increases slow down they may have the best prospects ahead.

Fig. 1: Bond ETFs: Govt-XGB, Corp-XCB, High Yield-XHY, US 20-yr-TLT – 2 years – Yahoo Finance

Currencies

As the US has raised interest rates more aggressively than any major economy around the world (except Canada just recently), the US Dollar has been strengthening in response. We have observed a slight USD strengthening trend vis-à-vis the Canadian Dollar for over a year since May 2021. If you were to look at the USD against the Euro, British Pound, or Japanese Yen the impact is astounding. Our Canadian currency has somewhat held up against the USD more than others because 1) the price of our top export, crude oil, has strengthened and 2) the strength of the Canadian economy (especially housing market) has let the Bank of Canada raise interest rates (and hence strengthen the CAD) more than in Europe, the UK, or Japan.

Among the various impacts of swaying currencies, the two biggest ones a Canadian investor is likely concerned about come from a) the value of our US securities when converted back to CAD and b) the impact of the strengthening/weakening of the US Dollar on the overseas profits of multinationals.

While I think the interest rate spread between the US and other economies may be nearing its peak (and hence the currency pressure pushing the USD higher may also be nearing its peak), the other factor (the safe haven effect) has not come into play much. Thus, it is conceivable that if there is a safe haven panic, we see one more push higher of the USD before it plateaus and gradually weakens.

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

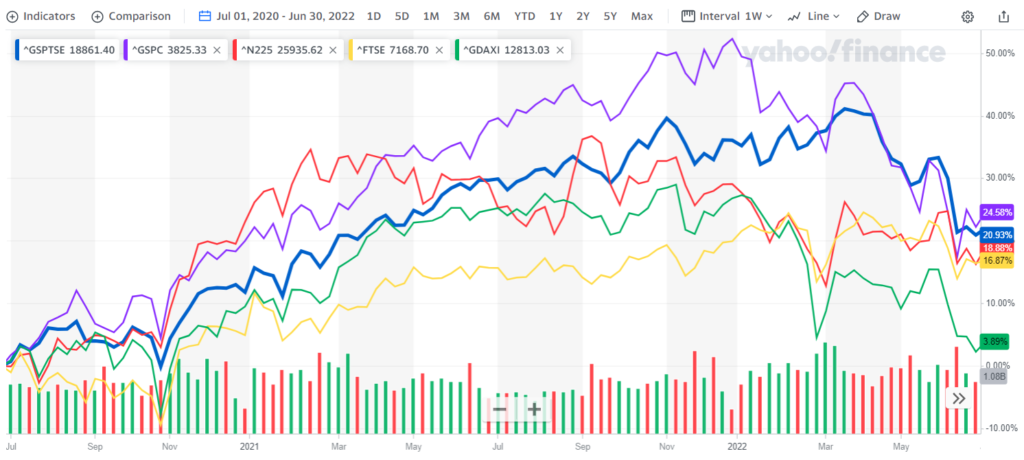

Stock Markets

In general, growth stocks (of which we own few) feel more pain from rising interest rates than value stocks (of which we own many). During this quarter we saw the stock market continue the retrenchment it has pursued since the new year. This has been substantially because the growth stocks have declined precipitously in response to rising interest rates.

Usually as a market pullback lengthens the more skittish investors panic and throw in the towel in something we call “capitulation.” At this point we haven’t seen substantial investor capitulation however we have seen a few days when there is a broad-based decline across many stocks. I am anticipating this could happen at any point, creating buying opportunities.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

Respectfully submitted,

Paul Fettes, CFA, CFP

Chief Executive Officer,

Brintab Corp.